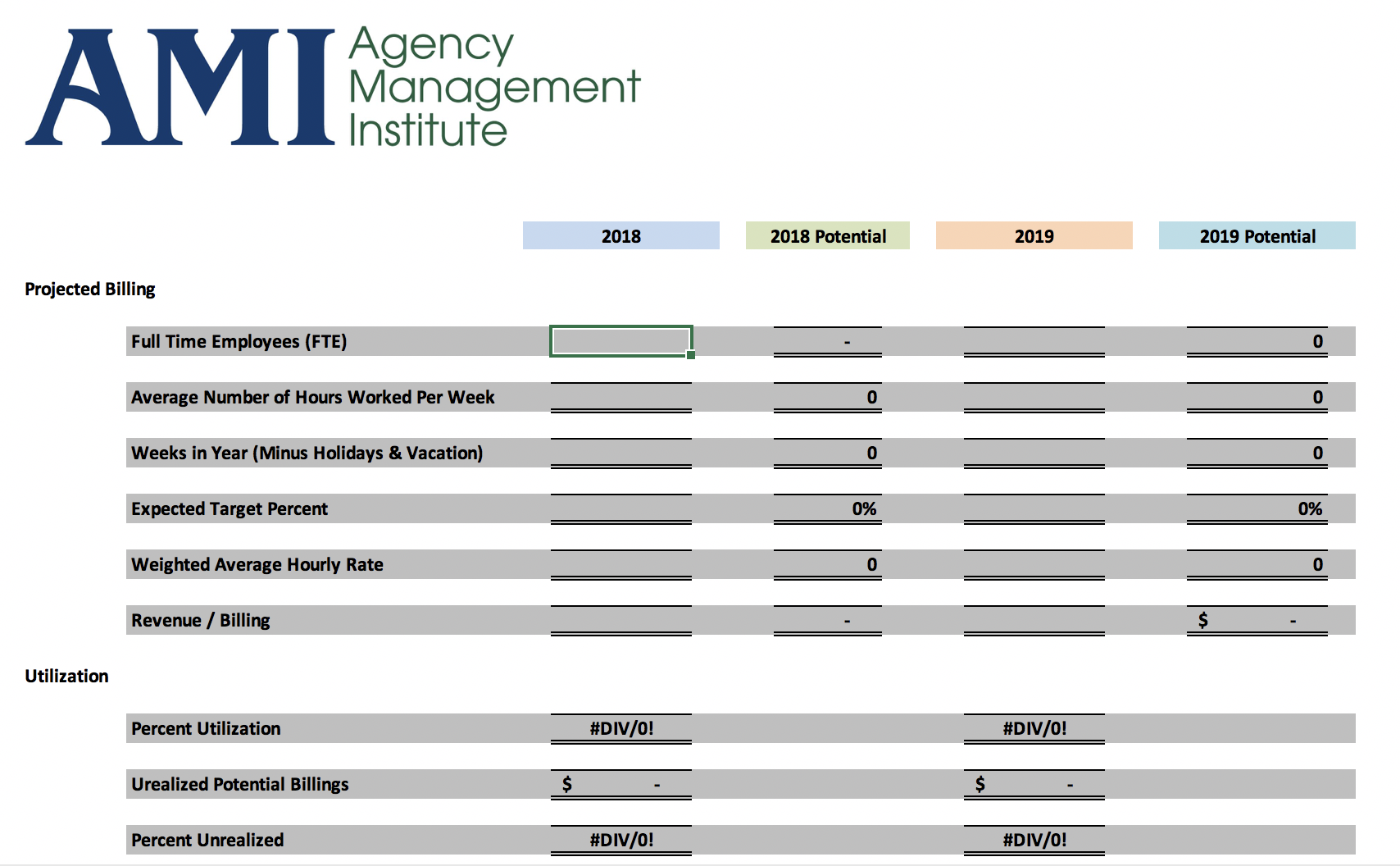

Here’s what you need to gather to use the AMI Billing Utilization Calculator:

- # of full-time equivalents you have on staff

- The average number of hours you expect them to work in a week (billable and non-billable)

- How many work weeks there are in your agency’s year (subtract holidays and vacation)

- What is your goal in terms of percentage of work hours that are billable. This needs to include ALL employees, whether you deem them to be billable or not*

- Your hourly rate (most of you use a blended rate, but if you need to — use a weighted average)

- Your annual gross billings for 2018 and 2019 year to date

Just plug those numbers into the spreadsheet (in the 2018 and 2019 columns) and see how much you’ve left on the table. If you’re unhappy with the results (as most of you will be) there are several reasons why you may not be billing as many hours as you’d like. That’s the topic for future videos, blog posts and certainly one of the things we discuss in the Money Matters workshop and on demand course.

*Remember the AMI rules of thumb here. You may not know them or even live by them yet… but keep them in mind when you view your results. If you violate either of these rules, it puts you at risk in terms of being profitable:

- No more than one non-billable (50% non-billable or more) for every 5 employees/FTEs

- Your entire agency (billable and non-billable) should be a minimum of 60% billable

Download the AMI Billing Utilization Calculator here.